Opinion & Analysis

A Product Approach to Data Monetization

Written by: dsocietydev

Updated 4:28 AM UTC, July 10, 2023

Part III of III

In Part I of this series, I addressed how to evolve from data project management to data product management, how to borrow from the traditional product management playbook to do so, and what to look for in a data product manager. Part II examined how to manifest a data product vision and understand the multitude of ways organizations are squeezing value from available data assets. Now let’s examine the various kinds of measurable economic benefits data can generate, the multiple ways to package or productize it, and overcoming data monetization myths and roadblocks.

Data Monetization Patterns

As I discussed in Infonomics, monetizing data can take various forms. Several patterns have emerged when assessing the hundreds of stories I have collected. Data monetization isn’t about selling data. More broadly and concisely, I define data monetization as generating new, measurable value streams from data assets. This definition opens a whole world of possibilities, including using available data that’s not necessarily your own (as discussed above) and generating a wide variety of economic or societal benefits — albeit ones that can be quantified.

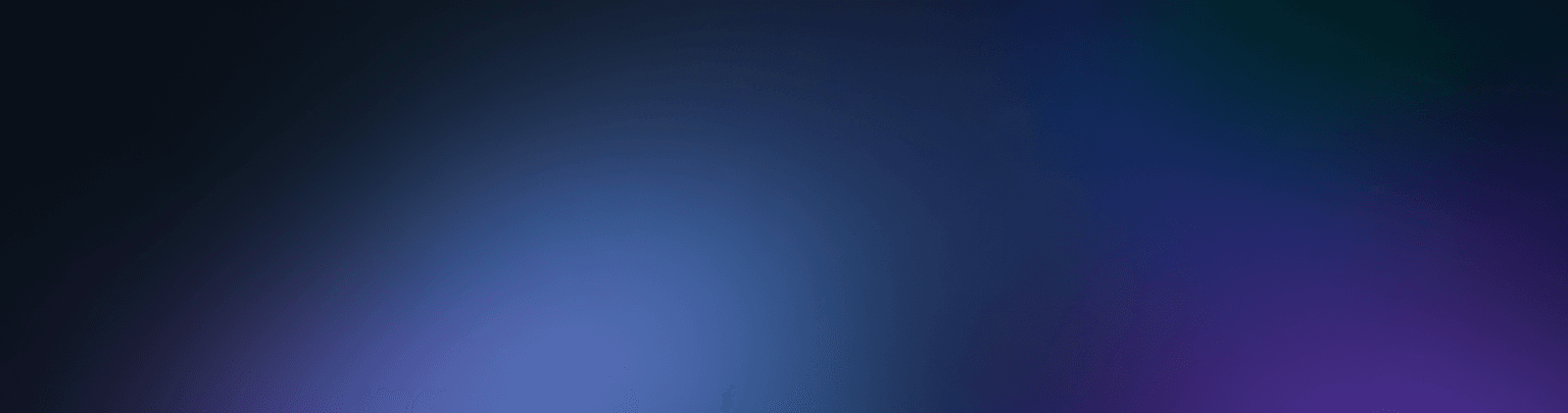

Data monetization falls into two broad categories: Indirect Data Monetization and Direct Data Monetization. Indirect data monetization involves solutions focused more on internal business processes that generate measurable returns, while direct data monetization involves externalizing data in return for some commercial consideration. (See Figure 1.)

1.png

Figure 1 – Data Monetization Patterns

Productizing and Packaging Data

But why fixate on just one data monetization method? Economists would call data a nonrivalrous, nondepleting, progenitive resource — one that can be used multiple ways simultaneously, doesn’t get “used up” when consumed, and typically generates more data when used. No, data is not “the new oil.” Oil has none of these incredible economic characteristics. And winning businesses are taking full advantage of data’s unique qualities.

As I mentioned in the last piece, businesses demonstrating data-savvy behavior have nearly a 200% greater market-to-book value than the market average. For data product companies (i.e., those that primarily sell data or data derivatives), this ratio is 300% higher. There’s no doubt that investors positively love data-driven companies.

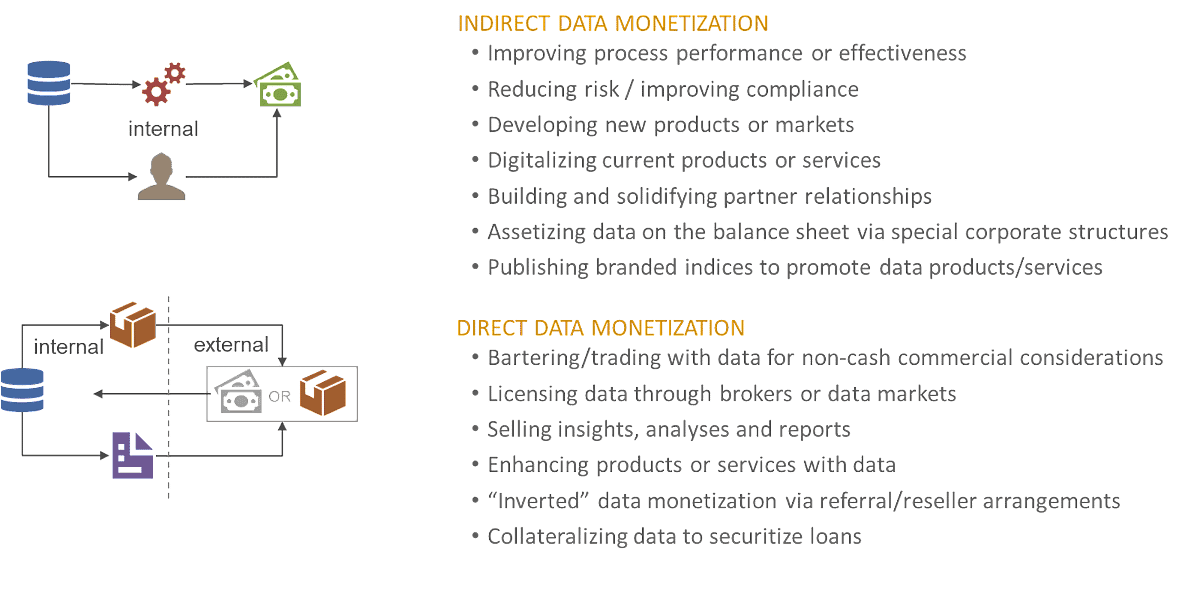

Because of these unique aspects of data, it can be packaged in numerous ways. (See Figure 2.) These range from publishing raw data, to rolling it up into analyses, to creating custom and integration solutions. However, as with other natural materials, the more you process them, the more expensive and exclusive they become. Consider wheat. Wheat is quite the commodity — relatively inexpensive but with massive global demand. It can be processed into different kinds of flour with a specific but still wide range of uses, then into breads that are more expensive and with a lesser range of uses. Finally, it can be integrated with other resources into sandwiches or cakes with more premium price tags and smaller, more localized markets.

Similarly, each subsequent step in processing your data assets can result in them delivering more specific and greater value to a smaller market or user base.

2.png

Figure 2 – Data Product Types

Your Data Monetization Journey

Even though data may have incredible properties that other assets and resources (such as physical materials, financial assets, human capital, and other intangibles) don’t, we shouldn’t consider it anomalous when generating value from it.

Instead, I recommend borrowing from well-honed product management approaches to lay out your data monetization function. (See Figure 3 – A Product Approach to Data Monetization.)

Central to treating data as an asset, data monetization should align with familiar research and development (R&D) and product management/marketing approaches. Not to oversimplify the many challenges and activities involved in monetizing data, certain basic concepts will reap significant rewards if executed well.

3.png

Figure 3 – A Product Approach to Data Monetization

The details, specific methods, and tools behind each phase and step are beyond the scope of this article. However, they are available via the courses and workshops I teach and the services my colleagues and I at West Monroe provide.

Overcoming Data Monetization Myths and Roadblocks

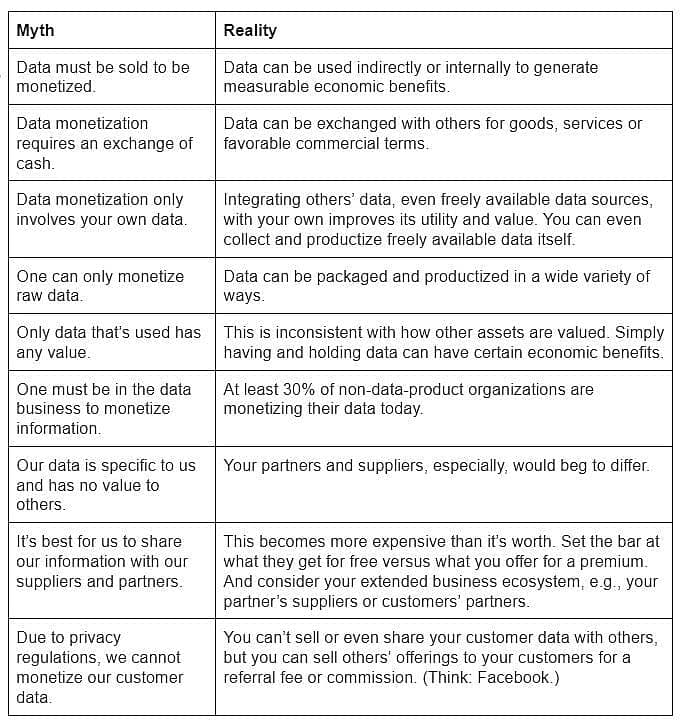

Along the road to conceiving and creating new data-driven value streams for your organization, you will invariably bump up against many data monetization myths and potential showstoppers. Prepare for them, or work with someone who can assist your organization in becoming more knowledgeable and well-prepared through workshops, a data literacy program, or a change management program.

Many myths about data monetization persist today and will continue until business leaders, legal counsels, CFOs and controllers, company executives and boards become more aware and better educated on the possibilities and realities of data.

Part 3 – Doug Laney.JPG

Once you’ve evolved your organization beyond these myths, you’ll still find a range of roadblocks along your journey that must be moved or navigated around, including:

-

Core business priorities making data monetization a low(er) priority.

-

Mental blocks due to data not (yet) being a recognized asset because of archaic accounting standards.

-

Legal, regulatory, or ethical roadblocks (perceived and real).

-

Already giving away data for free.

-

Insufficient foundational capabilities such as data integration, master data management, analytics, and storage/computing capacity.

-

Insufficient data quality (accuracy, completeness, timeliness, integrity, etc.).

-

No R&D culture, especially with data.

-

Lack of organizational experience and skills.

Final Infonomics Thoughts

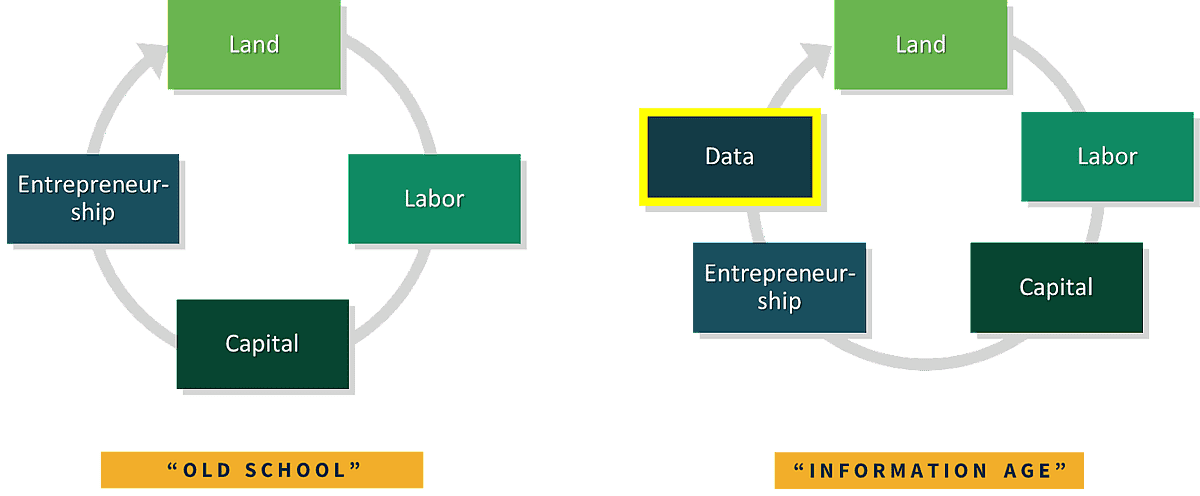

Economists have long touted the four factors of production as the key components of industry. They are Land, Labor, Capital, and Entrepreneurship. I contend that not only does (should) data qualify as an actual balance sheet asset, but it has ascended to become the fifth factor of production. (See Figure 4.) Data becomes a production factor in its own right but often is a substitute for other production factors. Data and algorithms have replaced labor and machines and shrunk on-hand inventory needs. In doing so, data has reduced the real estate footprint required to do business, as have digital solutions based on data and analytics. With AI applications, data has even replaced creativity and innovation in some domains, enabling new business models, solving problems, writing documents, and creating music and art.

4.png

Figure 4 – Data as the Fifth Factor of Production

While there is ample evidence that data can serve as an asset, a property, and a production factor, many businesses and business leaders continue to treat data as a mere component of pretty pie charts and dashing dashboards … or worse, as a mere business byproduct. And they continue to conflate data and technology.

These enterprises are lapped by those treating data as an asset and capitalizing on its unique economic qualities. The art of the possible with data has no limit. Or it is limited only by your business leaders’ imaginations and your organization’s ability to take a product management approach to becoming data-driven.

About the Author

Doug Laney is the Data & Analytics Strategy Innovation Fellow at West Monroe where he consults with business, data, and analytics leaders on conceiving and implementing new data-driven value streams. He originated the field of infonomics and authored the best-selling book, “Infonomics,” and the recent follow-up, “Data Juice: 101 Real-World Stories of How Organizations Are Squeezing Value From Available Data Assets.” Laney is a three-time Gartner annual thought leadership award recipient, a World Economic Forum advisor, a Forbes contributing author, and he co-chairs the annual MIT Chief Data Officer Symposium. He also is a visiting professor at the University of Illinois and Carnegie Mellon business schools, and sits on various high-tech company advisory boards.